The rhythm of Port Moresby is unlike anywhere else in the Pacific. On the waterfront, cargo ships unload containers that carry the lifeblood of trade, while just a few streets away, market vendors call out prices for fresh betel nut, taro, and sago. It is here, in the heart of Papua New Guinea’s capital, that the country’s complex economy reveals itself, a blend of the informal and the formal, the traditional and the modern. Expect the unexpected!” was the phrase that kept echoing in my mind repeated continuously by my hosts, as I ventured for the first time into PNG, a paradise-like land perched at the very edge of modern civilization. Following the quoted phrase is something truly remarkable, a strong unraveling of the PNG’s GST compliance drive.

Amid this mix, the Internal Revenue Commission (IRC) carries a heavy responsibility: to make certain that the goods and services tax (GST) delivers its true potential. For years, salary and wages tax, along with corporate income tax, have been the main sources of revenue. But the goal now is different.

Commissioner’s Vision

“Our vision is to make GST the number one revenue earner for the government,” said Sam Koim, Commissioner General of the IRC, when we sat down during the CATA Annual Heads Meeting 2025 that he hosted. Mr Koim spoke with measured clarity, his words reflecting both the scale of the challenge and the determination to meet it. “But under the current system, it has been a serious challenge.”

This exchange also carries a forward-looking note. At the upcoming PITAA Annual Heads Meeting 2025 in Tonga, his closest associate will join me on a panel I have the privilege of moderating on Real-Time Transaction Monitoring. In that sense, this conversation is not just a reflection on Papua New Guinea’s experiences, but also a prelude to the regional dialogue soon to unfold.

5 Key Takeaways

1. GST as the New Revenue Champion: Sam Koim’s vision is clear, transform GST into Papua New Guinea’s primary revenue source, shifting reliance away from wages and corporate income tax.

2. Tackling Structural Weaknesses: The IRC is confronting deep-rooted challenges, manual receipts, altered invoices, and an expansive informal sector, that undermine accurate GST collection and fairness in compliance.

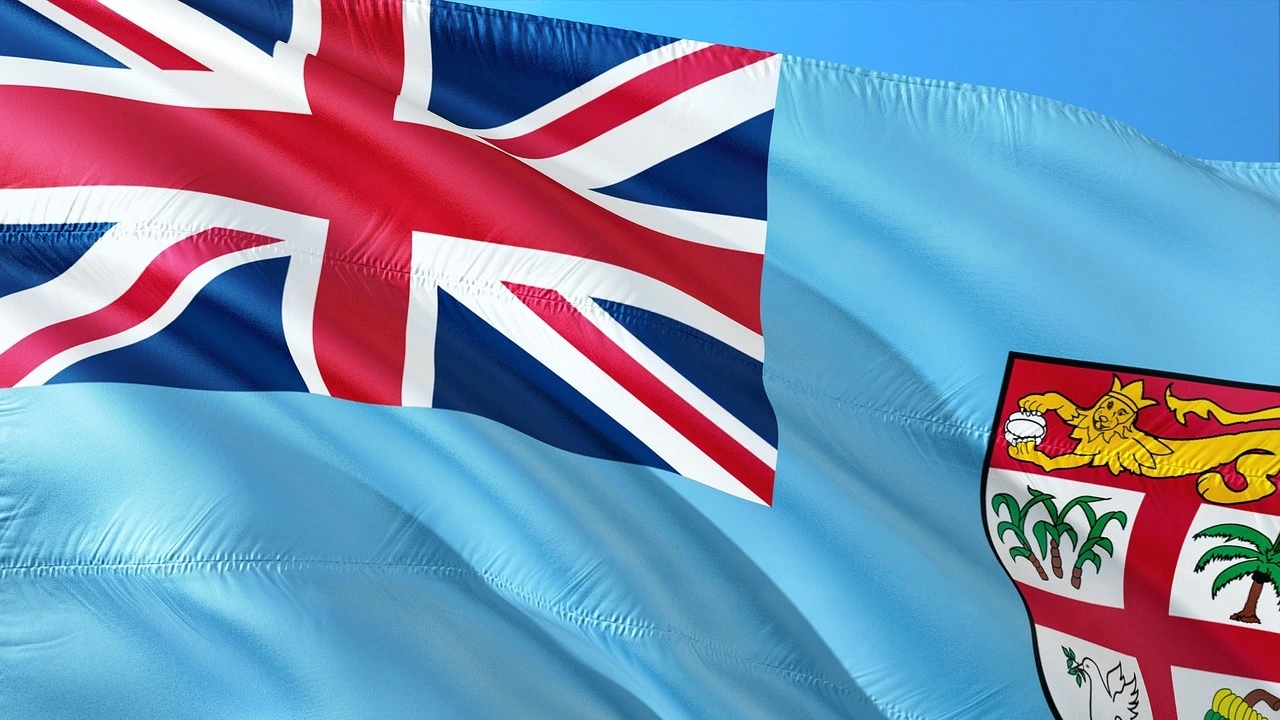

3. Learning from Fiji’s Experience: PNG studied Fiji’s VAT Monitoring System to adopt best practices and avoid pitfalls, creating a dedicated tax intelligence and data analytics division to ensure real-time data translates into actionable insights.

4. Businesses Gain Fairness and Relief: With the Goods and Services Tax Monitoring System (GMS), businesses will no longer carry the heavy audit burden of faded paper trails. Real-time transaction monitoring ensures all players operate on a level field.

5. A Future Built on Trust and Balance: Koim’s ultimate goal is not higher taxes but the right taxes, collected fairly, consistently, and transparently. Thru embedding trust and efficiency, the IRC aspires to be one of the Pacific’s best-run public institutions.

PNG’s GST Compliance: The Challenges Before GMS

For years, salary and wages tax and corporate income tax consistently outperformed GST in Papua New Guinea. This imbalance created a pressing challenge for the Internal Revenue Commission (IRC). If GST was to become the government’s leading source of revenue, deep structural issues had to be addressed, chief among them underreporting, underpayment, and a lack of reliable data.

Commissioner General Sam Koim explained that many businesses still depend on outdated methods: manual processes, paper receipts, and point-of-sale systems that are neither standardized nor secure. These practices created wide gaps in reporting and made it easy for transactions to slip through the cracks. “More often than not, when we audit taxpayers, they tell us they don’t have invoices, or the invoices are missing. Sometimes invoices are altered, or they simply fade with time,” Koim said. “Auditing becomes a tedious and burdensome process.”

Beyond these technical shortcomings lies another obstacle: PNG’s vast informal sector. From small-scale market vendors to community-run businesses, countless transactions take place daily without ever being recorded. This makes it nearly impossible for the IRC to capture the full scope of GST activity, leaving the tax base shallow and uneven.

Koim was clear-eyed about the consequences. Without a modern monitoring system, revenue collection would remain fragmented, compliance would lag, and honest taxpayers would continue to feel unfairly disadvantaged. “If we want GST to deliver on its potential, we need a system that brings everyone into the same framework,” he emphasized.

That realization led to the introduction of the Goods and Services Tax Monitoring System (GMS), powered by TaxCore. For Koim, this is a decisive step toward building a tax administration rooted in fairness, efficiency, and trust. A true PNG’s GST compliance effort in the making.

Knowledge-Sharing with Fiji

The Pacific region has become a testing ground for real-time tax monitoring, and PNG has been watching closely. Fiji’s VAT Monitoring System, powered by TaxCore, provided both inspiration and cautionary lessons.

“We’ve learned from Fiji in our bilateral discussions,” Koim said. “We saw the positive impact on compliance and revenue. But we also noted the challenges, like the difficulty of using real-time data effectively without the right capacity.”

To avoid similar pitfalls, PNG created a tax intelligence and data analytics division before rolling out its own monitoring system. Staff have been recruited and trained so that once the system captures real-time data, the IRC can immediately analyze and use it. “We are preparing ourselves to use the insights, not just collect the information,” Koim explained.

He also emphasized the importance of involving businesses early in the process. “Stakeholder engagement is critical. Shop owners, enterprises, taxpayers, they all need to understand what this system does and how it benefits them. Awareness is key.”

PNG’s GST Compliance: What Businesses Can Expect

When asked what message he would send directly to businesses and taxpayers, Commissioner General Sam Koim’s response was immediate and firm. Leaning forward, he underscored a principle that lies at the heart of tax reform: “The biggest benefit is fairness.”

For decades, businesses in Papua New Guinea have carried the weight of compliance through manual systems. Receipt books, faded invoices, and stacks of paper not only consumed time but also created opportunities for mistakes, disputes, and unfair outcomes. With the GMS Koim explained that this burden will be lifted. “The system will replace manual receipt submissions with real-time data, removing much of the pressure from businesses,” he said. “We will no longer subject them to the tedious process of producing receipts for audits, because the data will already be there.”

This shift means more than convenience. By capturing transactions at the source, the GMS removes inconsistencies that once left honest taxpayers exposed to arbitrary penalties, while others managed to escape scrutiny. “Everyone will play on the same field,” Koim continued. “Those who comply will no longer feel disadvantaged, and those who avoid taxes will be brought into the system.”

Looking further ahead, Koim described how the current PNG’s GST compliance drive could unlock broader reforms. With accurate transaction data readily available, the IRC envisions moving toward pre-filled tax returns, where much of the compliance work is done in advance by the commission. “This is the critical step toward that future,” he said. “It’s in the mutual interest of government and taxpayers to work together. The government gains clarity and consistency, while businesses gain certainty and ease.”

Building an IRC for the Future

Under Koim’s leadership, the IRC has pursued reforms aimed at building trust and efficiency. When asked what excites him most about the future, his response was one way street.

“I want an IRC where systems flow, processes flow, and people work together toward one purpose,” he said. His vision is not to collect more tax, but to collect the right tax. “The idea is not for taxpayers to pay more, but to pay right. When everyone is part of the tax net, there is fairness and balance. The government can plan with confidence, and businesses know they are treated equally.”

Koim’s aspiration is for the IRC to be recognized as one of the best-run public sector organizations in the Pacific. “That is the kind of IRC I see in the future,” he said with quiet determination.

As our conversation ended, I thanked him for sharing his thoughts and for the commitment he brings to reforming revenue administration in Papua New Guinea. His reply reflected both responsibility and optimism: “This is not just about the IRC. It’s about building fairness and trust for the country as a whole.”