At the heart of Africa’s economic debate lies a problem that rarely makes headlines yet touches every school, hospital, and public road – revenue collection. Unfortunately, across the continent, governments continue to chase development goals with budgets that never seem to match the ambition. Now, it must be noted that the gap is not always caused by a lack of will or vision. More often, it is because revenue slips through cracks too wide to ignore. At that exact fiscal crossroad, Data Tech International – DTI is at DGA2025 to share its vast knowledge.

Taxes that should fund public services vanish in cash economies where transactions go unrecorded. Goods and services pass across borders and into markets without ever entering official registers. Outdated reporting systems bury tax officials under stacks of paper that fade faster than the memories of those who issued them. For a continent that will soon hold a quarter of the world’s population, such inefficiencies are barriers to growth, equity, and political stability.

This is the context in which the discussion around revenue assurance has shifted. No longer an administrative exercise, it has become a decisive factor in whether governments can deliver for their people. And at DGA2025, the annual gathering where digital governance takes center stage, one theme will be resonating DTI’s approach: Africa needs the next-generation tax monitoring and reporting solution.

DTI at DGA2025: The Tax Gap That Refuses to Shrink

Unfortunately, the continent’s fiscal hole is visible and expanding. According to African Union estimates, countries collectively lose tens of billions of dollars every year through tax evasion, avoidance, and underreporting. Domestic resource mobilization, the polite term for improving tax collection, has been a staple of policy reports for over a decade. Yet, progress remains slow.

Part of the problem lies in the absence system or having a non-functional system. In many African countries, businesses still handwrite receipts, store them in filing cabinets, and present them to auditors months later, if at all. Tax authorities have no ability to verify what is accurate and what has been altered. In the meantime, governments run deficits, and citizens lose confidence that taxes are collected fairly.

This vicious cycle affects budgets, yes. Moreover, it shapes politics as well. When citizens suspect that the tax net is full of holes, they question why they should comply. When businesses know competitors can underreport with little risk of detection, they feel disadvantaged. And when governments lack reliable revenue, they turn to external borrowing, often at steep interest rates, locking future generations into repayment cycles that stifle development. DTI will focus on finding answers to these questions as well, during the participation at DGA2025.

Why Technology Matters Now?

The call for “next-generation” digital tax monitoring and reporting solution is quite pragmatic. Traditional audit-based tax systems were built for economies where transactions happened on paper, within easily tracked supply chains, and in relatively small numbers. Africa’s economies today are different.

From the sprawling informal markets to the fast-growing digital payments sectors, millions of transactions happen every second. Capturing them with old methods is impossible. Now more than ever, what is needed is not more auditors with clipboards but systems that can record data in real time, analyze it instantly, and flag inconsistencies before they turn into losses.

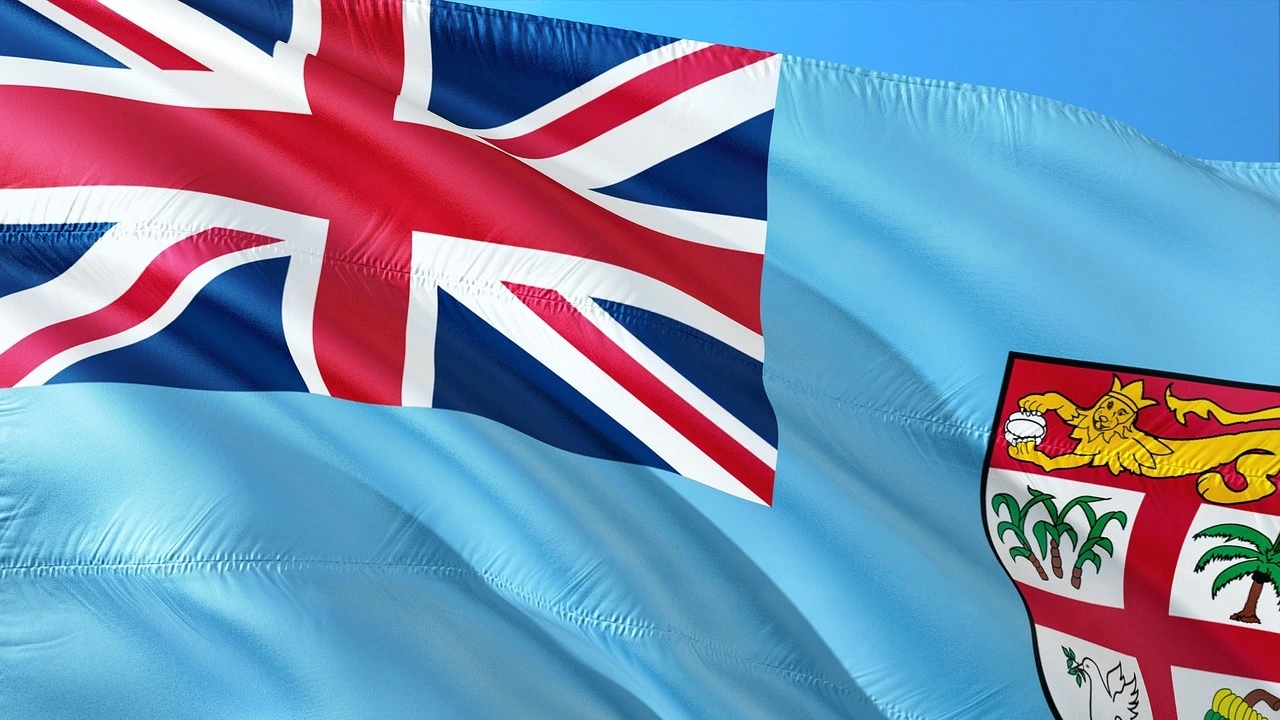

Countries in the Pacific, where DTI is heavily engaged, like Fiji and Samoa have shown what happens when governments shift to real-time monitoring of sales and value-added taxes. Compliance rates rise. Honest businesses welcome a fairer playing field. And tax authorities finally have the clarity they need to plan national budgets with confidence. African governments should examine these examples closely, as they won’t seem as distant experiments but as models that are highly adaptable to their own realities.

DTI at DGA2025: View from the Ground

For years now, DTI has worked hard to build TaxCore®, a COTS solution that fits the technical capacity and economic conditions of each country we work in. In practice, that means that our solution is capably to thrive in various tech environments, record every transaction at the point of sale, issue secure digital receipts and feeds the data instantly into tax authority databases. It is a system that removes the uncertainty of manual reporting and builds a continuous chain of evidence from seller to state.

From DTI’s perspective, the value of such a system goes beyond technology. TaxCore® brings fairness into the fiscal relationship. Taxpayers see that compliance is not discretionary, but they also gain relief from arbitrary audits and burdensome paperwork. Governments receive clarity not through guesswork but through data they can trust.

“Revenue assurance is not about raising taxes,” as Goran Todorov, CEO at DTI explained in a recent discussion. “It is about collecting the right taxes, consistently and transparently. When the system is fair, trust follows.” This emphasis on fairness should resonate across African capitals too. From Kigali to Lusaka, finance ministries understand that their citizens will support reforms only if they believe the rules apply equally to everyone. And this is exactly why digital tax monitoring becomes an excellent administrative tool. A tool that goes far beyond what is technically intended for, as it can serve as a pragmatical instrument for building legitimacy.

The Informal Sector: Africa’s Persistent Puzzle

Still, the road ahead is not simple. Africa’s vast informal economies, ranging from open-air markets to small family enterprises, pose a challenge we saw in other regions of the world. By some estimates, more than 80 percent of employment in sub-Saharan Africa exists outside the formal system. Asking these businesses to suddenly comply with digital reporting may seem unrealistic.

Yet, this is precisely where next-generation revenue assurance can make a difference. Instead of expecting informal vendors to fill out paperwork, governments can offer them simplified digital tools linked directly to tax authority platforms. Mobile receipts, QR codes, and offline-enabled applications can capture data without disrupting daily trade.

Countries that have experimented with such approaches report early signs of progress. Vendors who once resisted taxation begin to accept it when compliance becomes simple, when systems are accessible in local languages, and when the benefits, such as access to credit or eligibility for government programs, are visible.

DTI at DGA2025: A Continent-Wide Moment of Choice

What makes the discussion urgent now is not only the scale of the losses but also the timing. Africa is entering a demographic surge that will shape the global economy for the rest of the century. By 2050, the continent’s population will double, with millions more needing schools, jobs, and infrastructure. Governments cannot meet this demand if they continue losing revenue to inefficiency and underreporting.

International donors have long filled some of the gaps, but dependence on aid is increasingly seen as politically and economically unsustainable. Domestic revenue is the only durable source of funding for development. That is why finance ministers from across the African continent are pressing harder than ever for practical solutions.

At DGA2025, where digital governance leaders from around the world will gather, revenue assurance is not expected to dominate conversations, but DTI will raise this important topic across the board. It is obvious that African officials know that the continent cannot afford another decade of delay. They also know that adopting next-generation systems requires political will, technical training, and above all, trust between governments and citizens.

The Stakes for Global Confidence

We must be frank. Africa’s fiscal debate is not confined within its borders. International lenders, investors, and rating agencies watch closely. When governments demonstrate they can collect taxes efficiently, their creditworthiness improves and interest rates on loans decline. Thus, foreign direct investment becomes more attractive. Revenue assurance we talked earlier, in this sense, is not only about balancing national budgets but also about strengthening Africa’s place in the global financial system.

The opposite is equally true. Countries that fail to modernize remain trapped in cycles of debt and dependency, forced to pay higher premiums for capital while struggling to maintain basic services.

Toward a Fair Fiscal Future

DTI’s message at DGA2025 will echo this reality: practical digital tax monitoring is essential. It is the foundation of fair and transparent fiscal governance. With the right tools, Africa can reduce its dependence on external financing, restore confidence in its institutions, and give citizens tangible proof that taxes collected are taxes put to work.

As Sam Koim, the Commissioner General of Papua New Guinea’s Internal Revenue Commission, recently said in a related discussion about his own country’s reforms: “The idea is not for taxpayers to pay more, but to pay right.” And, Africa’s challenge is no different. The continent does not need higher taxes; it needs taxes collected fairly, consistently, and transparently. That is the promise of next-generation revenue assurance and the reason it cannot wait.